Why Is Box 2 Empty On My W2? - Complete Guide

Why is Box 2 Empty on My W-2?

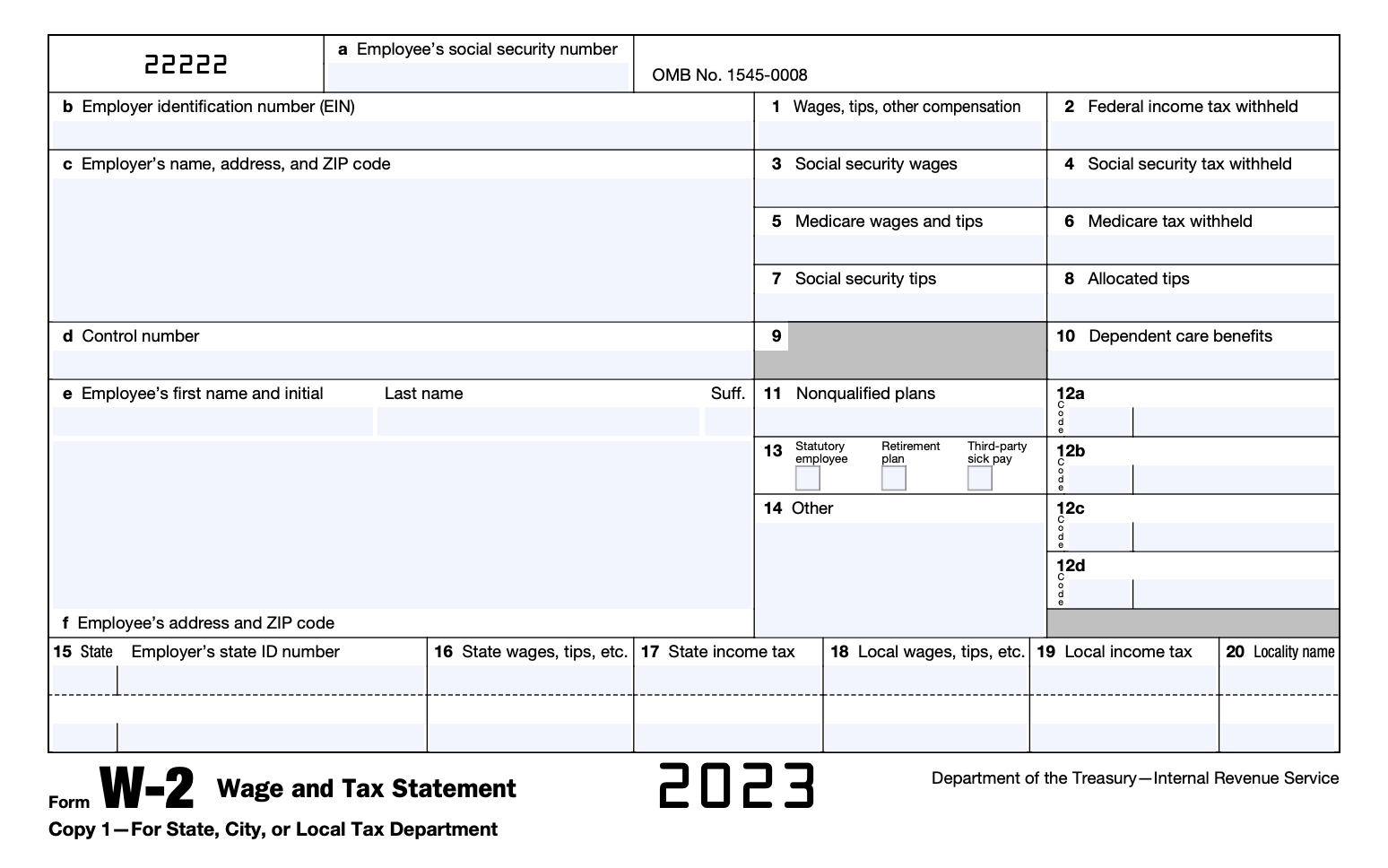

Box 2 of the W-2 form is used to report the employee's federal income tax withheld. If Box 2 is empty, it means that no federal income tax was withheld from the employee's wages. There are a few reasons why this may happen.

One reason why Box 2 may be empty is if the employee is exempt from federal income tax. This can happen if the employee has a low income, if they have a large number of dependents, or if they have made estimated tax payments.

Another reason why Box 2 may be empty is if the employee has had too much federal income tax withheld from their wages. This can happen if the employee has multiple jobs or if they have changed jobs during the year.

If Box 2 is empty, it is important to check the employee's withholding allowances. If the employee has too few withholding allowances, they may have too much federal income tax withheld from their wages. The employee can adjust their withholding allowances by submitting a new Form W-4 to their employer.

Why is Box 2 Empty on My W-2?

When filing your taxes, it's important to understand why Box 2 on your W-2 may be empty. Box 2 reports the federal income tax withheld from your wages, and an empty box can indicate various scenarios:

- Exemption: You may be exempt from federal income tax due to low income, dependents, or estimated tax payments.

- Over-withholding: Too much federal income tax may have been withheld if you have multiple jobs or changed jobs during the year.

- Incorrect Withholding: Your employer may have incorrectly calculated your withholding based on your Form W-4.

- Non-resident Alien: If you're a non-resident alien, you may not be subject to federal income tax.

- Special Circumstances: Certain tax credits or deductions can reduce your tax liability to zero.

- Error: It's possible that the empty box is simply an error on your W-2.

If you find Box 2 empty on your W-2, it's crucial to review your withholding allowances on Form W-4 and ensure they accurately reflect your tax situation. If necessary, you can adjust your withholding by submitting a new Form W-4 to your employer. Understanding why Box 2 is empty not only helps you file your taxes correctly but also ensures you're not overpaying or underpaying your federal income tax.

1. Exemption

When it comes to understanding why Box 2 on your W-2 is empty, it's essential to consider the concept of exemption from federal income tax. This exemption can arise due to several factors:

- Low Income: If your taxable income falls below a certain threshold set by the IRS, you may be exempt from paying federal income tax. This threshold varies depending on your filing status and the number of dependents you claim.

- Dependents: Claiming dependents on your tax return can increase your personal exemption amount, potentially reducing your taxable income to zero. Each dependent you claim represents a specific dollar amount that reduces your taxable income.

- Estimated Tax Payments: If you make estimated tax payments throughout the year, these payments are applied towards your final tax liability. If your estimated payments cover your entire tax liability, Box 2 on your W-2 will be empty because no additional federal income tax needs to be withheld from your wages.

Understanding the exemption criteria and how they relate to Box 2 on your W-2 is crucial for accurate tax filing. If you believe you meet any of these exemption criteria, it's advisable to consult with a tax professional to ensure your tax liability is correctly calculated and that you're not overpaying taxes.

2. Over-withholding

Over-withholding occurs when more federal income tax is withheld from your wages than you ultimately owe. This can happen if you have multiple jobs or change jobs during the year, as each employer withholds taxes based on the assumption that you will earn that amount from them for the entire year. As a result, you may end up having too much tax withheld overall.

- Multiple Jobs: When you work for multiple employers simultaneously, each employer withholds taxes based on your reported income from that job only. However, your total income from all jobs combined may push you into a higher tax bracket, resulting in over-withholding.

- Job Changes: If you change jobs during the year, the new employer will withhold taxes based on your new salary without considering the income you earned from your previous job. This can lead to over-withholding, especially if you started the new job at a higher salary.

Box 2 on your W-2 reflects the total federal income tax withheld from your wages during the year. If you have over-withholding, Box 2 will show a higher amount than what you actually owe. This overpayment will be refunded to you when you file your tax return.

3. Incorrect Withholding

When exploring why Box 2 on your W-2 may be empty, it's essential to consider the possibility of incorrect withholding. This occurs when your employer miscalculates the amount of federal income tax withheld from your wages based on the information you provided on your Form W-4.

- Inaccurate Allowances: The number of withholding allowances you claim on your Form W-4 directly impacts the amount of tax withheld. If you claim too many allowances, your employer will withhold less tax than you owe, potentially resulting in an empty Box 2 on your W-2.

- Marital Status Changes: If you experience a change in marital status during the year, such as getting married or divorced, you may need to update your Form W-4 to reflect your new status. Failure to do so can lead to incorrect withholding and an empty Box 2.

- Multiple Jobs: If you work multiple jobs concurrently and have not properly allocated your allowances across your W-4s, it can result in incorrect withholding. One job may withhold too little tax, while the other withholds too much, ultimately leading to an empty Box 2 on one of your W-2s.

- Employer Error: In some cases, the employer may make an error in calculating your withholding based on your Form W-4. This can happen due to misinterpreting the information provided or making a mathematical error.

Incorrect withholding can have implications for your tax liability. If too little tax is withheld, you may end up owing taxes when you file your return. Conversely, if too much tax is withheld, you will receive a refund when you file. It's important to review your Form W-4 annually and make adjustments as needed to ensure accurate withholding and avoid an empty Box 2 on your W-2.

4. Non-resident Alien

The connection between the statement "Non-resident Alien: If you're a non-resident alien, you may not be subject to federal income tax" and the question "why is box 2 empty on my w2" lies in the tax obligations of non-resident aliens in the United States.

Non-resident aliens are individuals who are not U.S. citizens or permanent residents and do not meet the substantial presence test. As such, they are not subject to U.S. income tax on their worldwide income. Instead, they are only taxed on their U.S.-source income, which generally includes income from U.S. businesses or investments.

In practice, this means that if you are a non-resident alien and your only income is from outside the United States, you will not owe any federal income tax. Consequently, your employer will not withhold any federal income tax from your wages, resulting in an empty Box 2 on your W-2.

It is important to note that there are exceptions to this rule. For example, non-resident aliens who are married to U.S. citizens or permanent residents may be subject to U.S. income tax on their worldwide income. Additionally, non-resident aliens who have a U.S. trade or business may also be subject to U.S. income tax on their business income.

If you are a non-resident alien, it is important to consult with a tax professional to determine your U.S. tax obligations. They can help you understand the tax implications of your specific situation and ensure that you are meeting your tax filing requirements.

5. Special Circumstances

The connection between "Special Circumstances: Certain tax credits or deductions can reduce your tax liability to zero" and "why is box 2 empty on my w2" lies in the impact of tax credits and deductions on an individual's overall tax liability. Box 2 on the W-2 form reports the federal income tax withheld from an employee's wages, and a zero balance in Box 2 indicates that no federal income tax was withheld.

- Tax Credits: Tax credits directly reduce the amount of tax you owe, dollar for dollar. Certain tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, are refundable, meaning that if the amount of credit exceeds your tax liability, you will receive a refund from the IRS. If you qualify for refundable tax credits that are greater than or equal to the amount of federal income tax you owe, Box 2 on your W-2 may be empty.

- Itemized Deductions: Itemized deductions reduce your taxable income, which in turn can reduce your tax liability. If you itemize deductions on your tax return and the total amount of your deductions is greater than the standard deduction, your taxable income will be lower. A lower taxable income means less federal income tax owed, potentially resulting in an empty Box 2 on your W-2.

- Standard Deduction: The standard deduction is a specific dollar amount that you can deduct from your taxable income before calculating your tax liability. The standard deduction varies depending on your filing status and is typically higher for married couples filing jointly. If your standard deduction is greater than or equal to your taxable income, you will not owe any federal income tax, and Box 2 on your W-2 will be empty.

- Other Deductions and Adjustments: Certain other deductions and adjustments, such as student loan interest deductions and educator expenses, can also reduce your taxable income. If you have a combination of deductions and adjustments that result in a taxable income of zero or less, you will not owe any federal income tax, and Box 2 on your W-2 will be empty.

In summary, special circumstances such as qualifying for refundable tax credits, itemizing deductions that exceed the standard deduction, or having a combination of deductions and adjustments that reduce your taxable income to zero can all result in an empty Box 2 on your W-2. It is important to note that these circumstances are specific to each individual's tax situation, and not everyone will have an empty Box 2 on their W-2.

6. Error

An empty Box 2 on your W-2, despite earning wages, can be indicative of an error on the W-2 form itself. This error could stem from various factors, including:

- Data Entry Mistake: Errors can occur during the process of data entry, leading to incorrect information being reported on the W-2. This could result in an empty Box 2 even though federal income tax was withheld from your wages.

- Payroll System Error: The payroll system used by your employer may encounter technical issues or miscalculations, resulting in an empty Box 2 on your W-2. This could be caused by software glitches, incorrect formulas, or system malfunctions.

- Human Error: Manual errors during the preparation of your W-2, such as overlooking the withholding of federal income tax, can lead to an empty Box 2. This could occur due to misinterpretation of tax laws or simple oversight.

- Printing or Distribution Error: After the W-2 is generated, errors can occur during the printing or distribution process. For instance, a printing error could result in an empty Box 2 on your copy of the W-2, while the original may contain the correct information.

It's important to note that an empty Box 2 on your W-2 does not necessarily mean that no federal income tax was withheld. If you believe there may be an error on your W-2, you should contact your employer to verify the accuracy of the information and request a corrected W-2 if necessary.

FAQs on "Why is Box 2 Empty on My W-2"

The following FAQs address common questions and misconceptions surrounding the issue of an empty Box 2 on a W-2 form:

Question 1: What does it mean if Box 2 on my W-2 is empty?An empty Box 2 on your W-2 form indicates that no federal income tax was withheld from your wages during the tax year. This can occur for various reasons, such as claiming exemptions on your Form W-4, over-withholding in previous years, or errors in calculating your withholding.Question 2: Is it a problem if Box 2 on my W-2 is empty?Whether or not an empty Box 2 is a problem depends on your individual tax situation. If you are exempt from paying federal income tax or have had too much tax withheld in the past, then an empty Box 2 is not an issue. However, if there was an error in calculating your withholding, you may end up owing taxes when you file your return.Question 3: What should I do if I believe there is an error on my W-2?If you believe there is an error on your W-2, you should contact your employer immediately. They can review your withholding information and issue a corrected W-2 if necessary.Question 4: Can I claim a refund if Box 2 on my W-2 is empty?Yes, you may be eligible for a refund if Box 2 on your W-2 is empty and you have overpaid your federal income taxes. You can claim a refund by filing a tax return with the IRS.Question 5: What is the deadline for filing a tax return if Box 2 on my W-2 is empty?The deadline for filing a tax return is typically April 15th, unless an extension is granted. However, if you are due a refund, there is no penalty for filing late.Remember, it's important to review your W-2 carefully and contact your employer or the IRS if you have any questions or concerns about the accuracy of your withholding information.

Transition to the next article section: Understanding the implications of an empty Box 2 on your W-2 can help you make informed decisions about your tax obligations and avoid potential tax-related issues.

Conclusion

In summary, an empty Box 2 on a W-2 form indicates that no federal income tax was withheld from an employee's wages during the tax year. This can occur due to various factors, including exemption from taxation, over-withholding in previous years, incorrect withholding calculations, or errors in W-2 preparation.

Understanding the reasons behind an empty Box 2 is crucial for taxpayers to ensure accurate tax filing and avoid potential tax liabilities. By reviewing withholding information carefully and addressing any errors promptly, individuals can safeguard their financial interests and fulfill their tax obligations effectively.

- Ronaldinhos Legendary Career A Journey Of Skill And Glory

- Benny Blancos Towering Stature How Tall Is The Music Producer

Why Are Social Security And Medicare Wages Different From Box 1

What Is W2 Form And How To Get W2 Wage And Tax Statement

When Are W2 Sent Out 2024 Maia Lauralee