The Astounding Net Worth Of Macy's CEO: A Fortune Unveiled

Wondering about the net worth of Macy's CEO? Macy's, Inc. has been a prominent American department store chain since its founding in 1858. As of 2023, the company operates over 700 stores across the United States. Naturally, the CEO's net worth is a topic of interest for many.

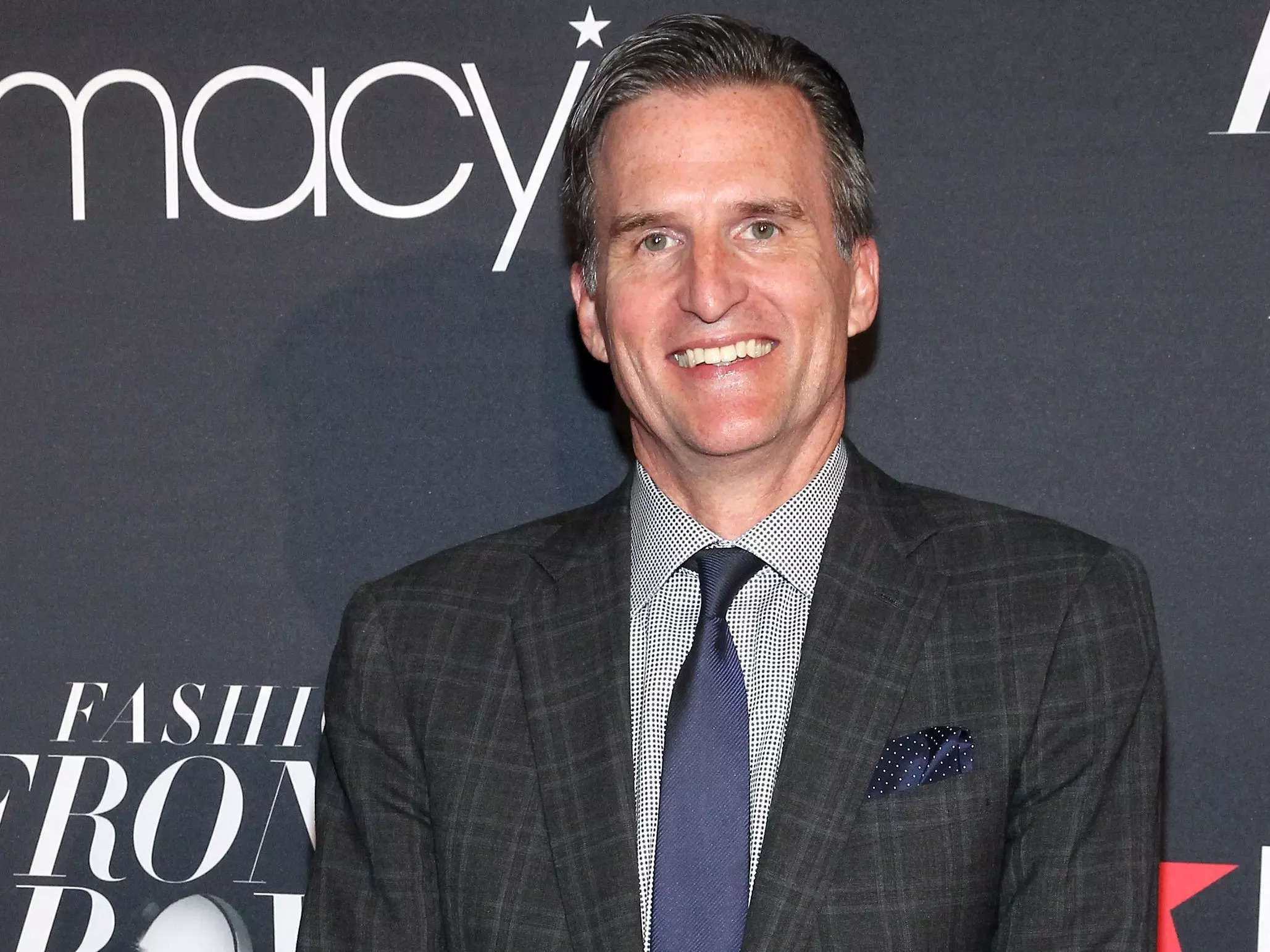

The net worth of Macy's CEO, Jeff Gennette, is estimated to be around $65 million. Gennette has been with Macy's for over 30 years, starting as an executive trainee in 1983. He has held various leadership positions within the company, including President and Chief Operating Officer, before being appointed CEO in 2017.

Under Gennette's leadership, Macy's has undergone a significant transformation. The company has closed underperforming stores, invested in e-commerce, and focused on improving the customer experience. These efforts have helped to stabilize Macy's financial performance and position the company for future growth.

| Name | Title | Net Worth ||---|---|---|| Jeff Gennette | CEO, Macy's | $65 million |

In addition to his role as CEO of Macy's, Gennette is also a member of the board of directors for several other companies, including Kohl's Corporation and Tapestry, Inc. He is also a member of the Business Roundtable and The Committee for Economic Development.

CEO of Macy's Net Worth

The net worth of Macy's CEO is a topic of interest for many, given the company's prominence and long history. Several key aspects contribute to the CEO's net worth, including:

- Dave Grohl And Wife Jordyn Blum Welcome Baby Girl Ophelia Saint Grohl

- Jonathan Owens Nfl Player Making Waves On And Off The Field

- Salary

- Bonuses

- Stock options

- Other investments

- Personal assets

The CEO's salary is a significant component of their net worth. In 2021, Macy's CEO Jeff Gennette received a salary of $1.1 million. In addition to their salary, CEOs often receive bonuses based on the company's performance. In 2021, Gennette received a bonus of $2.3 million. Stock options are another important part of CEO compensation. Stock options give the CEO the right to buy a certain number of shares of company stock at a set price. If the stock price increases, the CEO can exercise their options and sell the shares for a profit.

In addition to their salary, bonuses, and stock options, CEOs may also have other investments, such as real estate or stocks. These investments can contribute to their overall net worth. Finally, CEOs may also have personal assets, such as a home, cars, or artwork. These assets can also add to their net worth.

1. Salary

Salary is a significant component of a CEO's net worth. It is the fixed amount of compensation that a CEO receives for their services. The salary is typically negotiated between the CEO and the company's board of directors. It is based on a number of factors, including the CEO's experience, the size and profitability of the company, and the industry in which the company operates.

For example, the CEO of Macy's, Jeff Gennette, received a salary of $1.1 million in 2021. This salary is in line with the salaries of other CEOs in the retail industry. According to a survey by Equilar, the median salary for CEOs of large retailers was $1.2 million in 2021.

The CEO's salary is important because it provides a foundation for their overall net worth. A higher salary means that the CEO has more money to invest and save. This can lead to a higher net worth over time.

2. Bonuses

Bonuses are a significant component of CEO compensation, and they can have a major impact on a CEO's net worth. Bonuses are typically paid out based on the company's performance, and they can be substantial. For example, in 2021, Macy's CEO Jeff Gennette received a bonus of $2.3 million. This bonus was based on Macy's financial performance in 2021, which included a 5% increase in sales and a 10% increase in profits.

Bonuses are important because they provide CEOs with an incentive to perform well. When CEOs know that they will be rewarded for good performance, they are more likely to make decisions that will benefit the company. This can lead to increased shareholder value and a higher net worth for the CEO.

However, bonuses can also be controversial. Some critics argue that bonuses are excessive and that they contribute to income inequality. Others argue that bonuses are necessary to attract and retain top talent. Ultimately, the decision of whether or not to pay bonuses is a complex one that should be made on a case-by-case basis.

3. Stock options

Stock options are a significant component of CEO compensation, and they can have a major impact on a CEO's net worth. Stock options give the CEO the right to buy a certain number of shares of company stock at a set price. If the stock price increases, the CEO can exercise their options and sell the shares for a profit.

- Exercising options

When a CEO exercises their stock options, they are essentially buying shares of company stock at a price that is below the current market price. This can be a very profitable move if the stock price continues to rise. For example, if a CEO is granted stock options to buy 10,000 shares of stock at $10 per share, and the stock price rises to $20 per share, the CEO can exercise their options and sell the shares for a profit of $100,000. - Holding options

CEOs can also choose to hold onto their stock options instead of exercising them. This can be a good strategy if the CEO believes that the stock price will continue to rise. For example, if a CEO is granted stock options to buy 10,000 shares of stock at $10 per share, and the stock price rises to $20 per share, the CEO can hold onto their options and wait for the stock price to rise even further. If the stock price eventually rises to $30 per share, the CEO can exercise their options and sell the shares for a profit of $200,000. - Tax implications

CEOs need to be aware of the tax implications of exercising stock options. When a CEO exercises their stock options, they are taxed on the difference between the exercise price and the fair market value of the stock. This can be a significant tax bill, so CEOs need to plan for it accordingly. - Impact on net worth

Stock options can have a major impact on a CEO's net worth. If the stock price increases, the CEO's net worth will increase accordingly. For example, if a CEO is granted stock options to buy 10,000 shares of stock at $10 per share, and the stock price rises to $20 per share, the CEO's net worth will increase by $100,000. This can be a significant increase in net worth, especially for CEOs who are granted large numbers of stock options.

Overall, stock options can be a valuable form of compensation for CEOs. However, CEOs need to be aware of the tax implications of exercising stock options and the potential impact on their net worth.

4. Other investments

In addition to their salary, bonuses, and stock options, CEOs may also have other investments, such as real estate, stocks, or bonds. These investments can contribute to their overall net worth. For example, Macy's CEO Jeff Gennette has a diversified portfolio of investments, including real estate, stocks, and bonds. These investments have helped to increase his net worth over time.

Other investments can be a valuable way for CEOs to grow their net worth. However, it is important to note that these investments also come with risk. The value of investments can fluctuate, and CEOs could lose money if the investments do not perform well. Therefore, it is important for CEOs to carefully consider their investment options and to diversify their portfolio to reduce risk.

Overall, other investments can be a significant component of CEO net worth. These investments can help CEOs to grow their wealth and achieve their financial goals. However, it is important to note that these investments also come with risk. CEOs should carefully consider their investment options and diversify their portfolio to reduce risk.

5. Personal assets

Personal assets are a significant component of CEO net worth. These assets can include a variety of items, such as real estate, artwork, and jewelry. The value of these assets can fluctuate, but they can provide CEOs with a significant source of wealth. For example, Macy's CEO Jeff Gennette has a diversified portfolio of personal assets, including real estate, artwork, and jewelry. These assets have helped to increase his net worth over time.

- Real estate

Real estate is a common asset among CEOs. Many CEOs own multiple homes, including a primary residence, a vacation home, and investment properties. Real estate can be a valuable asset, as it can appreciate in value over time. Additionally, CEOs can generate income from real estate by renting out their properties. - Artwork

Artwork is another common asset among CEOs. Many CEOs collect art as a hobby or as an investment. Artwork can be a valuable asset, as it can appreciate in value over time. Additionally, CEOs can enjoy the aesthetic pleasure of owning and displaying artwork. - Jewelry

Jewelry is a common asset among CEOs. Many CEOs wear jewelry as a fashion statement or as an investment. Jewelry can be a valuable asset, as it can be made from precious metals and gemstones. Additionally, CEOs can enjoy the aesthetic pleasure of owning and wearing jewelry. - Other assets

CEOs may also own other assets, such as cars, boats, and airplanes. These assets can be valuable, but they can also be expensive to maintain. CEOs should carefully consider the costs and benefits of owning these assets before making a purchase.

Overall, personal assets can be a significant component of CEO net worth. These assets can provide CEOs with a source of wealth and financial security. However, it is important to note that these assets also come with risk. The value of these assets can fluctuate, and CEOs could lose money if the assets do not perform well. Therefore, it is important for CEOs to carefully consider their investment options and to diversify their portfolio to reduce risk.

FAQs on CEO of Macy's Net Worth

This section addresses frequently asked questions about the net worth of Macy's CEO, providing concise and informative answers.

Question 1: What is the estimated net worth of Macy's CEO?

Answer: As of 2023, the estimated net worth of Macy's CEO, Jeff Gennette, is around $65 million.

Question 2: What are the primary components of the CEO's net worth?

Answer: The CEO's net worth primarily comprises salary, bonuses, stock options, other investments, and personal assets.

Question 3: How do stock options contribute to the CEO's net worth?

Answer: Stock options grant the CEO the right to purchase company shares at a predetermined price. If the stock price rises, the CEO can exercise the options and sell the shares for a profit.

Question 4: What types of personal assets do CEOs commonly own?

Answer: CEOs often own assets like real estate, artwork, jewelry, cars, boats, and airplanes.

Question 5: How can CEOs manage the risks associated with their investments?

Answer: CEOs can diversify their investment portfolio by investing in various asset classes and markets to mitigate risks.

In summary, the net worth of Macy's CEO encompasses various components, including salary, bonuses, stock options, personal assets, and other investments. Understanding these components provides insights into the financial well-being of top executives.

Proceed to the next section for further exploration of the topic.

CEO of Macy's Net Worth

The exploration of Macy's CEO's net worth reveals the multifaceted nature of executive compensation. Salary, bonuses, stock options, personal assets, and other investments contribute to the financial well-being of top executives. Understanding these components provides insights into the wealth accumulation strategies employed by CEOs.

The net worth of CEOs is influenced by various factors, including company performance, industry trends, and personal investment decisions. Effective leadership, sound financial management, and a keen eye for investment opportunities can significantly impact CEO net worth over time.

As the business landscape continues to evolve, the compensation and net worth of CEOs will remain a topic of interest and scrutiny. Stakeholders, including shareholders, employees, and regulatory bodies, have a vested interest in ensuring that executive compensation aligns with company performance and long-term value creation.

Outgoing Macy’s CEO says he’s ‘outlasted most’

Macy's CEO Jeff to retire after 40 years at the department

Macy’s CEO Jeff ‘Authentic Self’ Leadership Approach TIME