All About: Why Is Box 2 On W-2 Blank?

Why is Box 2 on My W2 Blank?

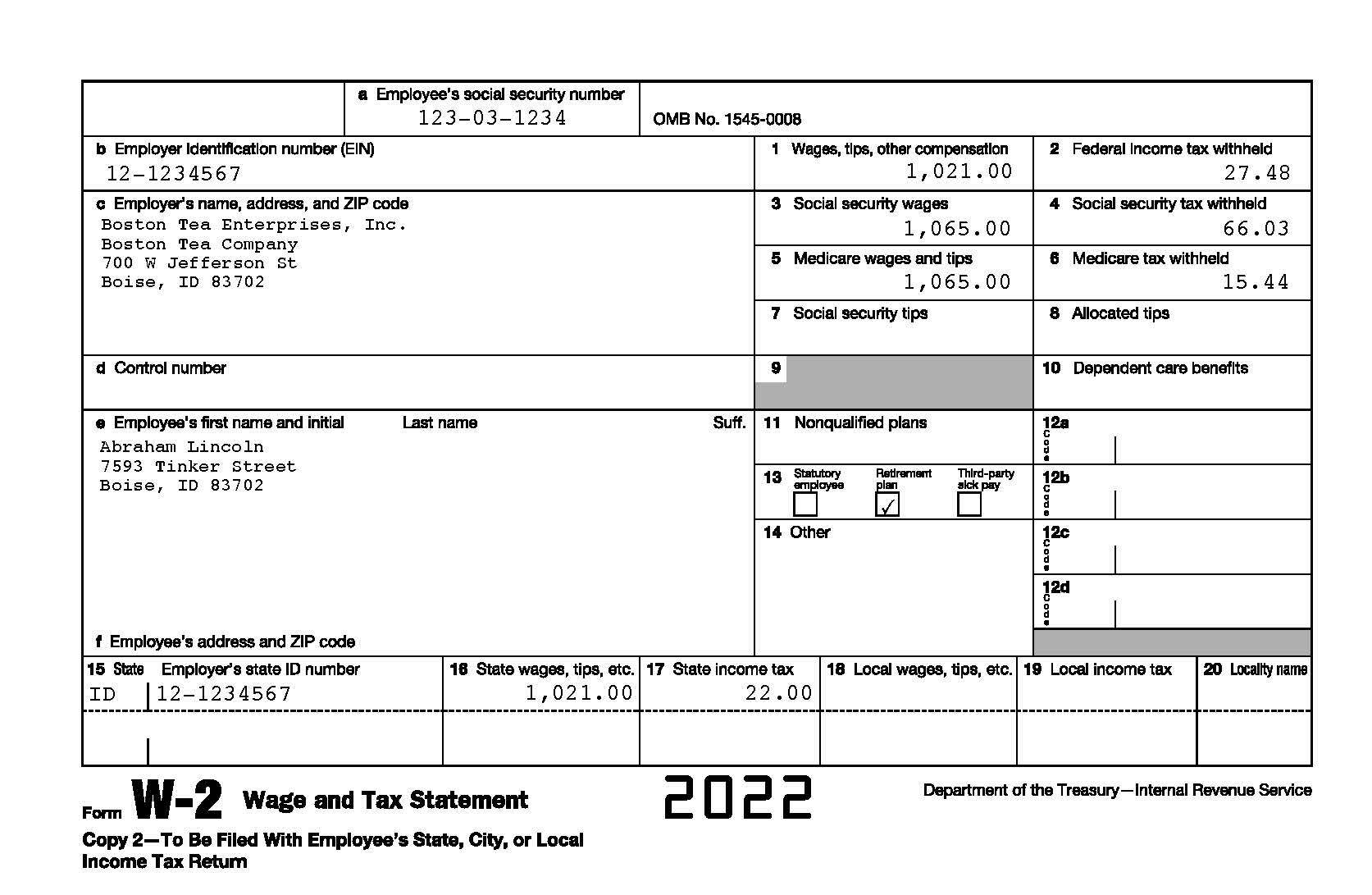

Box 2 on your W2 form is used to report your federal income tax withheld from your paycheck during the year. If this box is blank, it means that no federal income tax was withheld from your paycheck.

There are several reasons why Box 2 on your W2 might be blank. One possibility is that you are exempt from federal income tax withholding. This can happen if you have a very low income or if you have filed a Form W-4 with your employer claiming an exemption from withholding.

Another possibility is that you have had too little federal income tax withheld from your paycheck. This can happen if you have changed jobs during the year or if your income has fluctuated.

If you are unsure why Box 2 on your W2 is blank, you should contact your employer or the IRS.

Why is Box 2 on My W2 Blank?

There are several reasons why Box 2 on your W2 form might be blank. These include:

- Exemption from withholding

- Low income

- Fluctuating income

- Job change

- Incorrect withholding

- Tax refund

- Non-resident alien

- Backup withholding

If you are unsure why Box 2 on your W2 is blank, you should contact your employer or the IRS. They will be able to review your tax situation and determine why no federal income tax was withheld from your paycheck.

1. Exemption from withholding

One reason why Box 2 on your W2 might be blank is because you are exempt from federal income tax withholding. This means that you do not have to pay federal income taxes on your paycheck. There are several reasons why you might be exempt from withholding, including:

- Your income is below the filing threshold. The filing threshold is the minimum amount of income that you must earn in order to be required to file a tax return. If your income is below the filing threshold, you are not required to pay federal income taxes, and you can claim an exemption from withholding.

- You have had too much tax withheld in the past. If you have had too much tax withheld in the past, you can claim an exemption from withholding on your W-4 form. This will prevent your employer from withholding any federal income taxes from your paycheck.

- You are a non-resident alien. Non-resident aliens are not required to pay federal income taxes on their U.S. income. If you are a non-resident alien, you can claim an exemption from withholding on your W-4 form.

If you are unsure whether or not you are exempt from withholding, you should consult with a tax professional. They can help you determine if you are eligible for an exemption and how to claim it on your W-4 form.

2. Low income

One reason why Box 2 on your W2 might be blank is because you have a low income. The IRS has a specific income threshold for withholding federal income taxes. If your income falls below this threshold, you are not required to pay federal income taxes, and you can claim an exemption from withholding on your W-4 form.

- Exemption from withholding

If your income is below the filing threshold, you are not required to file a tax return. This means that you do not have to pay federal income taxes, and you can claim an exemption from withholding on your W-4 form.

- Reduced withholding

If your income is slightly above the filing threshold, you may still be able to reduce the amount of federal income tax that is withheld from your paycheck. You can do this by claiming additional allowances on your W-4 form.

- Refund

If you have too much federal income tax withheld from your paycheck, you will receive a refund when you file your tax return.

If you are unsure whether or not you should claim an exemption from withholding, you should consult with a tax professional. They can help you determine if you are eligible for an exemption and how to claim it on your W-4 form.

3. Fluctuating income

Fluctuating income can be a major factor in why Box 2 on your W2 is blank. This is because your employer is required to withhold federal income taxes from your paycheck based on your expected income for the year. If your income fluctuates throughout the year, your employer may not be able to accurately predict how much you will earn and may withhold too little or too much tax.

- Seasonal work

If you work in a seasonal industry, your income may fluctuate depending on the time of year. For example, if you work in retail, you may earn more during the holiday season than during other times of the year. This can make it difficult for your employer to withhold the correct amount of federal income tax from your paycheck.

- Commissions

If you earn commissions, your income may fluctuate depending on your sales performance. This can make it difficult for your employer to withhold the correct amount of federal income tax from your paycheck, as they may not know how much you will earn in a given month.

- Self-employment

If you are self-employed, your income may fluctuate depending on the number of clients you have and the amount of work you do. This can make it difficult to estimate your income for the year and can lead to under- or over-withholding of federal income taxes.

- Other factors

There are a number of other factors that can cause your income to fluctuate, such as changes in your job, changes in your family situation, or changes in the economy. These factors can all make it difficult for your employer to withhold the correct amount of federal income tax from your paycheck.

If you have fluctuating income, it is important to be aware of the potential impact on your tax withholding. You may need to adjust your W-4 form to ensure that the correct amount of federal income tax is being withheld from your paycheck. You can also make estimated tax payments to the IRS to avoid owing taxes when you file your tax return.

4. Job change

Job change can impact the amount of federal income tax that is withheld from your paycheck, which can lead to Box 2 on your W2 being blank.

- Change in income

When you change jobs, your income may change. This can be due to a change in your salary, a change in your hours worked, or a change in your job title and responsibilities. If your income changes, your employer will need to adjust the amount of federal income tax that is withheld from your paycheck. If your new income is lower than your previous income, your employer may withhold less tax. This could result in Box 2 on your W2 being blank.

- Change in withholding allowances

When you start a new job, you will need to complete a new W-4 form. On this form, you will indicate how many withholding allowances you are claiming. The number of withholding allowances you claim will affect the amount of federal income tax that is withheld from your paycheck. If you claim more withholding allowances, less tax will be withheld. This could result in Box 2 on your W2 being blank.

- Change in tax bracket

When you change jobs, you may move into a different tax bracket. Tax brackets are the ranges of income that are subject to different rates of tax. If you move into a lower tax bracket, your employer will withhold less tax from your paycheck. This could result in Box 2 on your W2 being blank.

- Other factors

There are a number of other factors that can affect the amount of federal income tax that is withheld from your paycheck, such as changes in your marital status, changes in your dependents, and changes in your tax deductions. These factors can all impact the amount of tax that is withheld from your paycheck and could result in Box 2 on your W2 being blank.

If you have changed jobs during the year, it is important to review your W-4 form and make sure that the information is correct. You may need to adjust your withholding allowances to ensure that the correct amount of federal income tax is being withheld from your paycheck.

5. Incorrect withholding

Incorrect withholding occurs when your employer withholds too little or too much federal income tax from your paycheck. This can happen for a number of reasons, including:

- Inaccurate W-4 form

The W-4 form is used by your employer to determine how much federal income tax to withhold from your paycheck. If the information on your W-4 form is inaccurate, your employer may withhold too little or too much tax. For example, if you claim more withholding allowances than you are entitled to, your employer will withhold less tax from your paycheck. This could result in you owing taxes when you file your tax return.

- Change in income

If your income changes during the year, your employer may need to adjust the amount of federal income tax that is withheld from your paycheck. For example, if you get a raise or start a new job, your employer will need to withhold more tax from your paycheck. If your income decreases, your employer may need to withhold less tax from your paycheck.

- Tax law changes

Changes in tax laws can also affect the amount of federal income tax that is withheld from your paycheck. For example, if the tax rates change, your employer will need to adjust the amount of tax that is withheld from your paycheck.

- Other factors

There are a number of other factors that can affect the amount of federal income tax that is withheld from your paycheck, such as your marital status, your dependents, and your tax deductions. If any of these factors change, you may need to adjust your W-4 form to ensure that the correct amount of tax is being withheld from your paycheck.

If you believe that your employer is withholding too little or too much federal income tax from your paycheck, you should contact your employer's payroll department. They can help you determine the correct amount of tax to withhold and make the necessary adjustments.

6. Tax refund

A tax refund is a payment from the government to a taxpayer who has overpaid their taxes. A tax refund occurs when the amount of tax withheld from your paycheck is greater than the amount of tax you actually owe at the end of the year. This can happen for a number of reasons, including:

- Withholding too much tax

If your employer withholds too much tax from your paycheck, you will receive a refund when you file your tax return. This can happen if you claim too many withholding allowances on your W-4 form or if your income decreases during the year.

- Tax credits

Tax credits are deductions from the amount of tax you owe. If you claim tax credits on your tax return, you may receive a refund even if you did not withhold too much tax from your paycheck.

- Filing status

Your filing status can also affect the amount of tax you owe. If you are married filing jointly, you may receive a larger refund than if you are single or married filing separately.

- Other factors

There are a number of other factors that can affect the amount of tax you owe, and therefore the amount of your refund. These factors include your income, your dependents, and your tax deductions.

If you receive a tax refund, you can use it to pay off debt, save for retirement, or invest in your future. However, it is important to remember that a tax refund is not free money. It is simply a return of the money that you overpaid in taxes. Therefore, it is important to make sure that you are not withholding too much tax from your paycheck, as this could result in a smaller refund or even owing taxes when you file your tax return.

7. Non-resident alien

A non-resident alien is an individual who is not a U.S. citizen or resident alien. Non-resident aliens are subject to different tax rules than U.S. citizens and resident aliens. One of the most important differences is that non-resident aliens are not required to pay federal income tax on their worldwide income. This means that Box 2 on their W-2 form will be blank.

- Income from U.S. sources

Non-resident aliens are only taxed on their income from U.S. sources. This includes income from employment, self-employment, and investments. Income from foreign sources is not taxed by the U.S. government.

- Tax treaty benefits

Non-resident aliens may be able to claim tax treaty benefits that reduce or eliminate their U.S. tax liability. Tax treaties are agreements between the U.S. and other countries that allow for the avoidance of double taxation.

- Filing requirements

Non-resident aliens are required to file a U.S. income tax return if they have any U.S. source income. The filing deadline is April 15th for most non-resident aliens.

- Withholding

Employers are required to withhold federal income tax from the paychecks of non-resident aliens. However, non-resident aliens can claim an exemption from withholding if they meet certain requirements.

The rules for non-resident aliens can be complex. If you are a non-resident alien, it is important to speak to a tax professional to make sure that you are complying with all of the applicable laws.

8. Backup withholding

Backup withholding is a type of withholding that is applied to payments made to certain individuals and businesses. It is intended to ensure that these individuals and businesses pay their taxes. Backup withholding can be applied to payments of income, such as wages, salaries, and pensions, as well as to payments of certain types of income, such as gambling winnings and payments to independent contractors.

- Failure to report a correct TIN

One of the most common reasons for backup withholding is the failure to report a correct Taxpayer Identification Number (TIN). A TIN can be a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN). If you do not report a correct TIN to the payer, the payer is required to withhold 24% of your payments.

- Notification of incorrect TIN

Backup withholding can also be applied if the IRS notifies the payer that the TIN you provided is incorrect. The IRS may send this notification to the payer if you have not filed a tax return for several years, if you have a history of filing incorrect tax returns, or if the IRS believes that you are using a false or stolen TIN.

- Backup withholding certification

In some cases, the IRS may require you to complete a backup withholding certification form. This form is used to certify that you are not subject to backup withholding. You may be required to complete this form if you have been notified by the IRS that you are subject to backup withholding, or if you have received a backup withholding notice from your payer.

- Consequences of backup withholding

Backup withholding can have a significant impact on your finances. If you are subject to backup withholding, 24% of your payments will be withheld and sent to the IRS. This can reduce your take-home pay and make it difficult to budget. If you are subject to backup withholding, you should contact the IRS to determine why and how to stop it.

Backup withholding is an important tool that the IRS uses to ensure that taxes are paid. However, it can also be a burden for taxpayers who are not subject to backup withholding. If you are subject to backup withholding, you should contact the IRS to determine why and how to stop it.

Why is Box 2 on My W2 Blank? - FAQs

This section provides answers to frequently asked questions (FAQs) about why Box 2 on your W2 form may be blank.

Question 1: Why is Box 2 on my W2 blank?

Answer: Box 2 on your W2 form is used to report your federal income tax withheld from your paycheck during the year. If this box is blank, it means that no federal income tax was withheld from your paycheck.

Question 2: What are some reasons why Box 2 on my W2 might be blank?

Answer: There are several reasons why Box 2 on your W2 might be blank, including being exempt from withholding, having low income, fluctuating income, having a job change, incorrect withholding, receiving a tax refund, being a non-resident alien, or being subject to backup withholding.

Question 3: What should I do if Box 2 on my W2 is blank?

Answer: If Box 2 on your W2 is blank, you should contact your employer or the IRS to determine why no federal income tax was withheld from your paycheck.

Question 4: Can I get a refund if Box 2 on my W2 is blank?

Answer: Yes, you may be eligible for a refund if Box 2 on your W2 is blank and you overpaid your taxes. You can file a tax return to claim your refund.

Question 5: What is backup withholding?

Answer: Backup withholding is a type of withholding that is applied to payments made to certain individuals and businesses. It is intended to ensure that these individuals and businesses pay their taxes.

Summary of key takeaways or final thought:

If you have any questions about why Box 2 on your W2 is blank, you should contact your employer or the IRS. They will be able to provide you with more information and help you determine if you are eligible for a refund.

Transition to the next article section:

For more information about W2 forms, please refer to the IRS website.

Conclusion

Box 2 on your W2 form is used to report your federal income tax withheld from your paycheck during the year. If this box is blank, it means that no federal income tax was withheld from your paycheck. There are several reasons why Box 2 on your W2 might be blank, including being exempt from withholding, having low income, fluctuating income, having a job change, incorrect withholding, receiving a tax refund, being a non-resident alien, or being subject to backup withholding.

If you have any questions about why Box 2 on your W2 is blank, you should contact your employer or the IRS. They will be able to provide you with more information and help you determine if you are eligible for a refund.

Tax Form 2022 14

Irs Estimated Tax Forms 2024 Faun Marjie

Form W2 Box 1 Guide for Navigating Through Confusing Discrepancies