Daily Net Worth: Your Ultimate Guide To Tracking And Maximizing Wealth

Hey there, finance enthusiasts! If you're reading this, chances are you've been wondering about your daily net worth and how it plays a crucial role in your financial health. Your daily net worth is more than just a number; it's a snapshot of your financial standing. Understanding it can transform how you approach money management, investments, and even your lifestyle. So, buckle up as we dive deep into the world of net worth, and learn how you can track and grow your wealth like a pro.

Now, let’s get one thing straight—your net worth isn’t just for the rich or famous. It’s a tool that everyone, from college students to retirees, can use to assess their financial situation. Whether you're aiming for financial independence or just trying to get a better handle on your money, knowing your daily net worth is the first step towards smarter financial decisions.

But hold up—before we get too deep into the numbers, let’s clear up what daily net worth really means. It’s not just about how much money you have in your bank account or how much your house is worth. It’s about the big picture: your assets minus your liabilities. Stick around, and we’ll break it down for you step by step.

Understanding Daily Net Worth: The Basics

So, what exactly is daily net worth? Simply put, it's the difference between what you own (your assets) and what you owe (your liabilities). Think of it as a financial report card that gives you a clear picture of where you stand financially on any given day. But why does it matter, you ask? Well, your daily net worth can help you identify areas where you can improve your financial health, set realistic financial goals, and track your progress over time.

Why Daily Net Worth Matters

Tracking your daily net worth isn't just about knowing the numbers—it's about understanding the story behind them. By keeping an eye on your net worth, you can:

- Identify trends in your financial habits.

- Spot potential issues early, like rising debt or stagnant investments.

- Make informed decisions about spending, saving, and investing.

And let’s be real, who doesn’t love seeing their net worth grow? It’s like watching your favorite sports team win—it gives you that sense of accomplishment and motivation to keep pushing forward.

How to Calculate Your Daily Net Worth

Calculating your daily net worth might sound intimidating, but trust me, it’s simpler than you think. All you need to do is add up all your assets and subtract all your liabilities. Here’s a quick breakdown:

Assets: What You Own

Your assets include everything you own that has monetary value. This could be your cash, investments, real estate, vehicles, and even valuable collectibles. Here’s a list of common assets:

- Cash in savings and checking accounts.

- Investments like stocks, bonds, and mutual funds.

- Real estate properties.

- Vehicles like cars, boats, or motorcycles.

- Retirement accounts like 401(k)s or IRAs.

Liabilities: What You Owe

On the flip side, liabilities are all the debts and financial obligations you have. This includes credit card balances, loans, mortgages, and any other outstanding payments. Some common liabilities include:

- Mortgage or rent payments.

- Car loans or leases.

- Credit card balances.

- Student loans.

- Personal loans or lines of credit.

Once you’ve got your assets and liabilities sorted, subtract the total liabilities from the total assets, and voila—you’ve got your daily net worth!

Common Mistakes to Avoid When Tracking Daily Net Worth

While tracking your daily net worth is straightforward, there are a few common pitfalls that people fall into. Let’s take a look at some of these mistakes and how you can avoid them:

1. Ignoring Non-Monetary Assets

Some folks forget to include non-monetary assets like valuable art, jewelry, or even their business in their net worth calculations. Make sure to account for everything that has value, even if it’s not in cash or investments.

2. Overestimating Property Values

It’s easy to get carried away with estimating the value of your home or other properties. Stick to realistic market values and avoid inflating numbers based on wishful thinking.

3. Forgetting About Hidden Debts

Liabilities aren’t always obvious. Things like unpaid taxes, legal judgments, or even potential liabilities from lawsuits should be factored into your calculations.

Tools and Apps to Track Your Daily Net Worth

In today’s digital age, there’s no shortage of tools and apps that can help you track your daily net worth. Whether you prefer a simple spreadsheet or a sophisticated app, here are a few options to consider:

1. Mint

Mint is a popular app that allows you to connect all your financial accounts in one place. It automatically updates your net worth and provides insights into your spending habits.

2. Personal Capital

Personal Capital is another great tool for tracking net worth, especially if you’re into investing. It offers detailed reports on your investments and helps you plan for retirement.

3. Google Sheets

If you’re old-school like me, a good old-fashioned spreadsheet can do the trick. Just set up a few formulas, and you can easily calculate your daily net worth without any fancy apps.

Strategies to Increase Your Daily Net Worth

Now that you know how to calculate your daily net worth, let’s talk about how to increase it. Here are a few strategies that can help you grow your wealth:

1. Pay Down Debt

Reducing your liabilities is one of the fastest ways to boost your net worth. Focus on paying off high-interest debt first, like credit card balances or personal loans.

2. Invest Wisely

Investing is a powerful way to grow your assets over time. Consider diversifying your portfolio with a mix of stocks, bonds, and other investment vehicles.

3. Increase Your Income

Boosting your income can have a direct impact on your net worth. Whether it’s through a side hustle, a promotion, or a new job, every extra dollar counts.

The Psychology of Daily Net Worth

Let’s be honest—money can be an emotional topic. Understanding the psychology behind your daily net worth can help you make better financial decisions. Here are a few things to keep in mind:

1. Avoid Comparing Yourself to Others

It’s easy to get caught up in comparing your net worth to others, but remember that everyone’s financial journey is unique. Focus on your own progress and goals.

2. Celebrate Small Wins

Whether it’s paying off a small debt or reaching a savings milestone, celebrate your achievements along the way. It’ll keep you motivated and focused on the bigger picture.

Real-Life Examples of Daily Net Worth

To give you a better idea of how daily net worth works in real life, let’s look at a couple of examples:

Example 1: John Doe

John is a 35-year-old marketing manager with the following assets and liabilities:

- Assets: $500,000 (home), $100,000 (savings), $150,000 (investments).

- Liabilities: $250,000 (mortgage), $20,000 (car loan).

John’s daily net worth: $480,000.

Example 2: Jane Smith

Jane is a 28-year-old software engineer with the following assets and liabilities:

- Assets: $20,000 (savings), $50,000 (retirement account).

- Liabilities: $30,000 (student loans), $5,000 (credit card debt).

Jane’s daily net worth: $35,000.

Expert Tips for Maximizing Your Daily Net Worth

As someone who’s been in the finance game for a while, I’ve picked up a few tips that can help you maximize your daily net worth:

1. Automate Your Savings

Set up automatic transfers to your savings or investment accounts. This ensures that you’re consistently adding to your assets without even thinking about it.

2. Review Your Expenses Regularly

Take a hard look at your expenses every month and identify areas where you can cut back. Even small changes can add up over time.

3. Stay Educated

Knowledge is power, especially when it comes to finance. Stay updated on the latest trends, investment opportunities, and financial strategies to make informed decisions.

Conclusion: Take Control of Your Daily Net Worth

And there you have it—a comprehensive guide to understanding, calculating, and maximizing your daily net worth. Remember, your net worth is just one piece of the financial puzzle, but it’s a crucial one. By tracking it regularly and making smart financial decisions, you can set yourself up for long-term success.

So, what are you waiting for? Grab a pen and paper (or your favorite app) and start calculating your daily net worth today. And don’t forget to share this article with your friends and family—knowledge is power, and the more people who understand their finances, the better off we all are.

Got any questions or tips of your own? Drop a comment below, and let’s keep the conversation going!

Table of Contents

- Understanding Daily Net Worth: The Basics

- How to Calculate Your Daily Net Worth

- Common Mistakes to Avoid

- Tools and Apps to Track Your Daily Net Worth

- Strategies to Increase Your Daily Net Worth

- The Psychology of Daily Net Worth

- Real-Life Examples of Daily Net Worth

- Expert Tips for Maximizing Your Daily Net Worth

- Conclusion

- All About Cody Rhodes Kids A Comprehensive Guide

- Benny Blancos Towering Stature How Tall Is The Music Producer

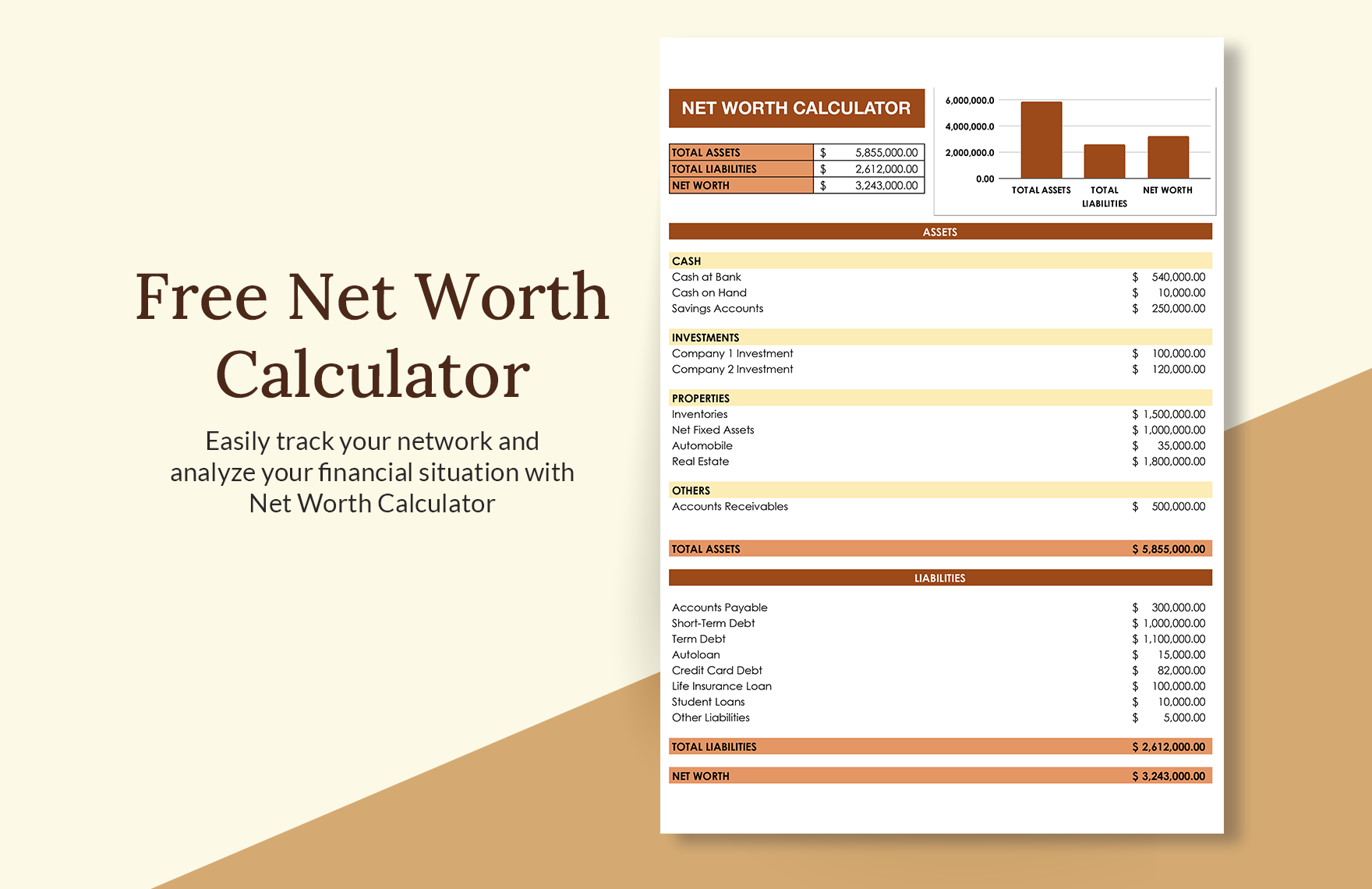

Free Net Worth Calculator Google Sheets, Excel

E.G. Daily Interview Career, Music & More SoundVapors

Steve Harvey 2024 Networth Net Worth Joly Thomasa